Pennsylvania Makes Betting Online Legal

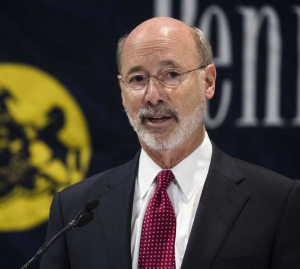

It’s official, on Monday; Pennsylvania’s Governor Tom Wolf signed the Gambling Expansion Bill turning it into law. Pennsylvania, the nation’s second largest commercial casino state will now people to bet in airports, at truck stops and even on the internet.

It’s official, on Monday; Pennsylvania’s Governor Tom Wolf signed the Gambling Expansion Bill turning it into law. Pennsylvania, the nation’s second largest commercial casino state will now people to bet in airports, at truck stops and even on the internet.

Last week, the gambling industry was in full gossip mode when the Pennsylvania House of Representative passed the gambling expansion bill known as HB 271.

Yesterday, Pennsylvania became the fourth state in the union to allow online gambling and going even further by allowing commercial casinos and its state lottery to be played online. Wolf was not in favor of expanding the gambling bill but saw it as a way to balance the deficit without having to increase state taxes.

"There's been a lot of pressure from a lot of places in the commonwealth to actually expand this, and we do need some recurring revenue," Wolf said Monday. "Again, the goal has been, all along, to do what's prudent, not cannibalize existing gambling revenue coming to the state, and I think what we're settling on will actually do that."

The gambling bill mostly passed as a way to break a budget stalemate to get rid of a $2.2 billion deficit.

The gambling bill mostly passed as a way to break a budget stalemate to get rid of a $2.2 billion deficit.

Now that the new bill is in effect, this means that 10 of Pennsylvania’s 12 casinos will be able to bid on getting a mini-casino license that will allow them to expand their operation in the state. The bidding for each license will start at $7.5 million plus an extra $2.5 million to get a table game certificate. Each Mini-casino will be allowed to have up to 750 slot machines and 30 table games.

In addition, casinos will now be able to offer gambling parlors in airports thought Pennsylvania and qualifying truck stops will now be able to operate up to 5 slot machines.

In terms of online gambling, this means that online poker, online table games, online slots, daily fantasy sports, and internet lottery sales are now legal in Pennsylvania. The cost for an online poker license, online table games and slot machines will cost $4million each but can be had at a discount of $10 million if a casino applies for all three.

The gaming tax rate will be 14% on gross gaming revenue plus an additional 2 percent local tax.

Lawmakers in Pennsylvania expect to receive over $200 million annually from casino licenses, fees and taxes. The revenue potential within the state and from sports betting software companies is sure to draw the attention of other states. In fact, last year, Pennsylvania gambling industry made $1.4 billion in revenue from its gambling operations and that is a lot of taxable money.